Is massage a medical cost that qualifies? Massage treatment IS PERMITTED AS A QUALIFIED MEDICAL EXPENSE IF ALL OF THE CRITERIA BELOW ARE MET. “Medical expenditures” are defined by the IRS as “costs associated with the diagnosis, cure, mitigation, treatment, or prevention of illness, as well as costs associated with therapies affecting any portion or function of the body.”

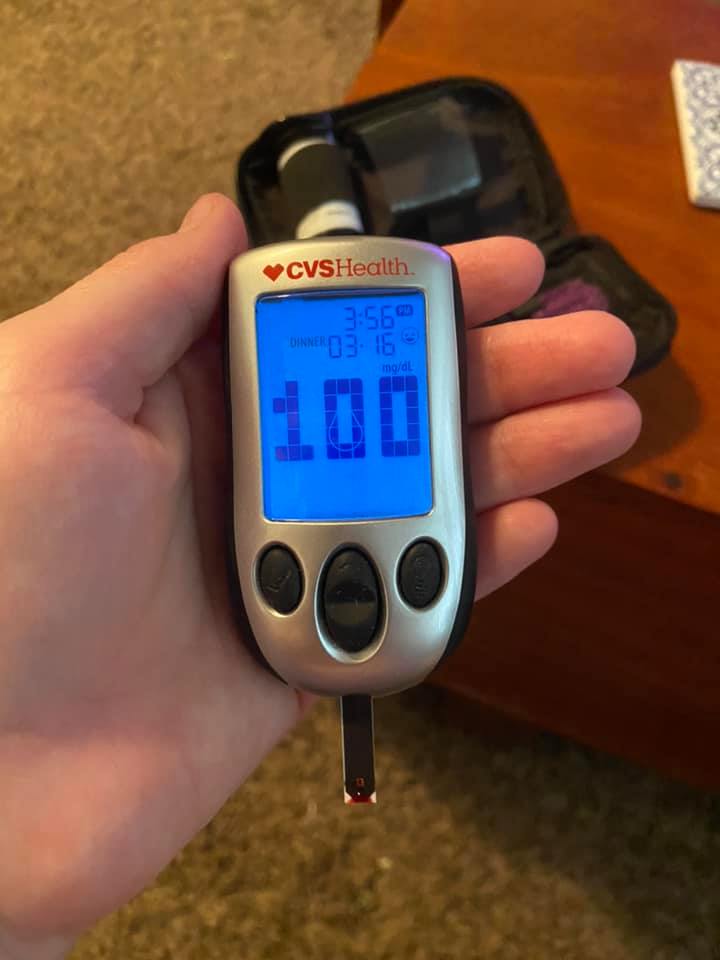

Thousands of people suffering from erratic blood sugar has been using this ground-breaking solution…

To help them burn away dangerous fat from their vital organs and bellies…

While stabilizing their blood sugar levels naturally and effectively.

And starting today…

Is massage covered by a health savings account? Massage therapy is covered by the majority of FSAs and HSAs. While some may need a Letter of Medical Necessity from your physician, this does imply that you may be eligible to get reimbursement from your insurer for your massage with us! All that is required is a letter from your primary care physician.

Are massages HSA-eligible? Massages accompanied by a physician’s letter of necessity In this instance, accountholders may utilize their HSA to cover the cost of the massage. To utilize your HSA to pay for the massage, you must produce a note from your doctor stating that therapeutic massage is really necessary.

Can DiaBetic Foot Massage be Deducted On Taxes – RELATED QUESTIONS

Is massage covered under the Flexible Spending Account?

Observe How It Works… If you have a Flexible Spending Account (FSA), you may be surprised to learn that Massage Therapy may be used to offset medical expenses. If your physician has ordered massage therapy treatments, you may use your FSA account to pay for them.

Can I use my health savings account to pay for physical therapy?

You certainly can. Because physical therapy services, such as those given at Natural Fit Therapy, come within the category of medical expenses that address the body’s structures and functions, you may use your HSA funds to pay for physical therapy treatment for yourself, your spouse, or your dependents.

Is it possible to utilize my HSA to purchase a hot tub?

Hot tubs are not covered by a flexible spending account (FSA), a health savings account (HSA), a health reimbursement arrangement (HRA), a dependent care flexible spending account (DCFSA), or a limited-purpose flexible spending account (LPFSA).

Is reflexology the same thing as foot massage?

Reflexology is a sort of massage in which various degrees of pressure are applied to the feet, hands, and ears. It is predicated on the hypothesis that various bodily parts are associated with specific organs and body systems.

What occurs during a deep tissue massage?

It may aid in the alleviation of tense muscles, persistent muscular pain, and anxiety. Your massage therapist will use slow strokes and firm finger pressure to release tension in the deepest levels of your muscles and connective tissues during a deep tissue massage. You may be nude or in your underwear for this massage.

Is a foot massager suitable for a Flexible Spending Account?

Inserts for shoes and foot care Wart removers and other foot grooming procedures, such as callus trimmers, are also eligible for reimbursement under the FSA. You may even be able to use your FSA to buy a foot massager.

How can I use my FSA to pay for massage?

Once you’ve obtained your prescription, the next step is to schedule an appointment with a registered massage therapist. Pay for the session using your HSA or FSA debit card and you’re ready to go! If you want to join, you just connect your HSA/FSA debit card account and then sit back and relax.

Can I use my HSA funds to purchase vitamins?

Weight-loss supplements, nutritional supplements, and vitamins are often utilized for general health and are not considered acceptable HSA costs. Generally, HSA owners cannot deduct the cost of diet food or drinks from medical expenditures since they substitute for foods and beverages that are routinely eaten to meet nutritional demands.

Can I use my HSA funds to purchase glasses?

Can You Use a Flexible Spending Account or a Health Savings Account to Purchase Eyewear? It is acceptable to utilize an FSA or HSA to pay for prescription eyeglasses. These accounts may be used to pay for both glasses and contact lenses. Non-prescription eyewear is not eligible for reimbursement via an FSA or HSA, since it is not considered a medical cost.

Can HSA be used to purchase toothpaste?

Toothpaste is not covered by a flexible spending account (FSA), a health savings account (HSA), a health reimbursement arrangement (HRA), a limited-purpose flexible spending account (LPFSA), or a dependent care flexible spending account (DCFSA).

Can I use HSA to purify the air?

With a Letter of Medical Necessity (LMN), a flexible spending account (FSA), a health savings account (HSA), or a health reimbursement agreement, you may be qualified for air filter reimbursement (HRA).

Can I use my HSA funds to purchase an electric toothbrush?

Toothbrushes and Replacement Parts for Electric Toothbrushes General health goods such as toothbrushes are not eligible for reimbursement from a health FSA since they are used regardless of whether a dentist recommends them.

Is it possible to utilize my HSA to purchase an air purifier?

With a Letter of Medical Necessity, air purifiers may be paid via flexible spending accounts, health savings accounts, and health reimbursement accounts.

How often should you have massages?

Indeed, you may be massaged too often. You should attend no more than once a week unless you are struggling with discomfort or participating in high-intensity sports. You and your therapist will be able to identify the optimal frequency, since your body’s reaction plays a significant role in this conclusion.

Massages are they beneficial?

Massage benefits may include the following: Stress reduction and increased relaxation. Efforts to alleviate pain, muscular discomfort, and stress. Circulation, vitality, and alertness are improved.

How much do you tip a foot massage therapist?

As a recommendation, TripAdvisor, The Today Show, and Real Simple recommend tipping between 15% and 20% for spa services.

What does Swedish massage entail?

Swedish massage combines lengthy, kneading strokes with rhythmic tapping and joint movement. This style of massage focuses on the muscles’ topmost layer and seeks to alleviate muscular tension.

How many massages are required to eliminate knots?

Locate the tight locations (you probably won’t have to search very hard). Firmly push into the trigger points with your fingertips (or equipment such as foam rollers and massage balls). Repeat three to five times more, preferably five or six times each day. “It must become ingrained in one’s everyday habit,” Dr.

Is deep tissue massage supposed to be painful?

Deep tissue massages may produce some discomfort or mild pain in the troublesome regions. Discomfort is to be expected while receiving this form of massage treatment. The majority of customers describe it as a “nice pain,” one that is somewhat unpleasant but yet feels wonderful.

Are foot massagers covered under the HSA?

Our Products Qualify for HSA/FSA Benefits With one of our state-of-the-art foot massagers, you can say goodbye to weary, achy feet and aching calves. Equipped with Precise Point Technology to massage away aching feet’s aches and pains.

Are foot massagers effective?

There are several advantages to maintaining good foot health, which is why investing in a high-quality foot massage machine is an excellent investment. To list a few of the advantages of a foot massager: It has the potential to alleviate tension and stress. A massage may help to enhance circulation.

Is it possible to use an HSA foot massager?

Massage therapy is eligible for payment via flexible spending accounts (FSAs), health savings accounts (HSAs), and health reimbursement arrangements (HRAs) with a Letter of Medical Necessity (LMN) (HRA).

My successful Diabetes Treatment Story

My doctor diagnosed me with diabetes just over a year ago, at the time I was prescribed Metformin. I went to the some diabetes related websites and learned about the diet they suggested. I started the diet right away and I was very loyal to it. However, after weeks of being on the diet it never helped, my blood sugar didn’t drop like I wanted it to. My personal physician wasn’t much help either, he didn’t really seem to give me any other options besides my prescription and the usual course of insulin. I was about to give up and then I discovered a great treatment method. The guide was authored by one of the leading professionals in the world of diabetes research, Dr. Max Sidorov. This is a guide that that shows you, in a very simple way, how to conquer the disease without traditional methods. I have to say that since I’ve found the guide and followed it, I’ve not only improved my health but I’ve also lost weight and improved other aspects as well. My activities have increased and I have a ton of energy! It is my goal to share the this diabetes treatment method as much as possible to show people there’s more to the disease than traditional schools of thought and you can find your own path to healing with natural methods.Thousands of people suffering from erratic blood sugar has been using this ground-breaking solution…

To help them burn away dangerous fat from their vital organs and bellies…

While stabilizing their blood sugar levels naturally and effectively.

And starting today…